WESTMONT, Illinois (March 19, 2024) – LifeQuotes.com, the online life insurance price comparison service that offers instant quotes from 50 highly-rated life insurers, today released the results of a new market survey that reveals the best life insurance rates for women in honor of Women’s History Month.

“In honor of Women’s History Month, we have some very exciting news to share with women who are shopping for life insurance,” said LifeQuotes.com Vice President, Michelle Zieba. “Women who have dependents tend to be underinsured when it comes to life insurance. But we’re here with the good news that there is a robust, competitive market out there of life insurers competing to win your business. Even better is our no-pressure service model that has our salaried life insurance experts advising on the best plan for each family’s situation.”

The Life Insurance Marketing and Research Association (LIMRA) states that the “top reason women give for not purchasing life insurance is that they think it is too expensive. And 8 in 10 women tend to overestimate the cost of life insurance.”

Another common misconception about life insurance that deters women from purchasing life insurance is the belief that homemakers or stay-at-home mothers who are not employed are uninsurable. Zieba continued, “Life insurance is readily available to stay-at-home Moms. We recommend that stay-at-home Moms carry no less than $300,000 of coverage and that working Moms carry 10-15 times their annual income.”

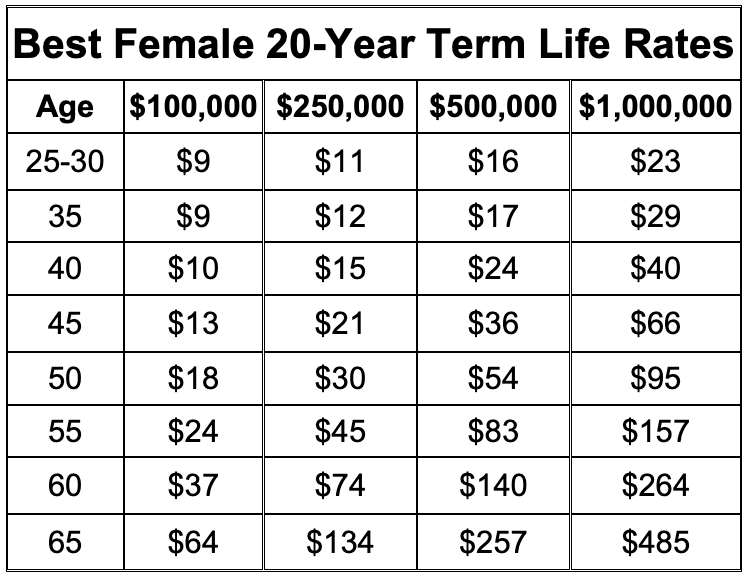

The chart below highlights the best life insurance rates available for female applicants on our #1 best-selling 20-year level term life policy, which covers death by any cause, at any time, in any place, except for suicide within the first two policy years (one year in some states). Beneficiaries received benefits tax-free. Other rate guarantees such as 10, 15, 25, 30-year, and lifetime are available at www.lifequotes.com.

Some sample rates shown offer instant decision underwriting with no medical exam required for those who are in good health or have minor health issues. Term life plans tend to be renewable, without evidence of insurability, to age 90+, and most offer the right to convert to a permanent insurance plan without having to undergo further underwriting.

Zieba described the life insurance application process. “After the initial quote, our life insurance experts will recommend the best fit for the customer. We handle the application preparation and retrieval of medical records so that the selected life insurer can make an underwriting decision. For applicants who are in good health, it’s often possible to skip the exam altogether and receive an instant decision offer of insurance in one phone call.”

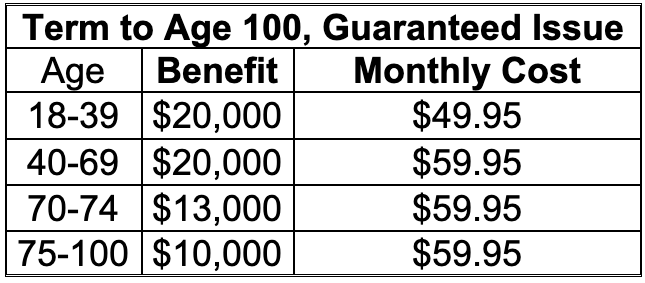

For those ages 18-74 wanting a simple plan to pay for funeral and other final expenses, here’s the schedule of premiums on a plan that asks no health questions and provides coverage to age 100. Coverage on this plan begins after an initial waiting period of 11 months.

Women are Underinsured

When it comes to life insurance, women are underinsured. According to LIMRA, “approximately 14 percent of women – more than 20 million – lost their life insurance coverage in 2020.” As of 2021, only 47 percent of adult women owned life insurance – lower than the ownership rate of men, at 58 percent.

Female life insurance ownership has been decreasing for the last five years in a row, leaving families unprotected (Forbes Advisor, 2024). However, research indicates that 66% of American parents worry about their family’s ability to cover expenses if they were to pass away. Customers can speak to one of our licensed professionals to determine the best policy fit for family protection at (800) 556-9393.

Recent Success Stories

LifeQuotes.com instantly compares rates from 50 leading life insurers, providing women of all health and lifestyle backgrounds with options to protect their families. The below examples of satisfied female customers with unique health profiles accentuate the importance of choosing to work with a knowledgeable agency that represents many insurers.

- Jamie G. of Hays, KS, female applicant in good health, age 45, was able to buy a $1,000,000 policy for $65 per month.

- Susan D. of Wattsburg, PA, Stage I breast cancer survivor who has been in remission since 2015, age 70 with a history of hypertension, was able to buy a $100,000 policy for $101 per month.

- Janet Z. of Wilmington, DE, Stage II breast cancer survivor who entered remission in 2021, age 60, height of 5’3” and 200lbs, was able to buy a $25,000 Whole Life policy for $105 per month.

- Hope F. of Needham Heights, MA, female applicant currently taking Sertraline to treat anxiety, age 45 with a diagnosis of chronic ulcerative colitis, was able to buy a $1 million policy for $67 per month.

- Felicia B. of Crittenden, KY, female applicant with generalized anxiety disorder, age 38, was able to buy a $100,000 policy for $10 per month.

- Sandra W. of Erwin, TX, female with a history of hypertension and high cholesterol, age 70, was able to buy a $10,000 Whole Life policy for $50 per month.

Zieba offered this advice to women who are shopping for life insurance, “Female applicants can do a lot to prepare to buy life insurance. Have a list of your prescriptions and doctors ready, as well as your Social Security number. Our illustrations list each plan’s acceptance guidelines, so expect to spend a few minutes with our salaried agents on which plan best fits your health profile and budget. These steps will ensure you get the lowest-possible pricing and quickest underwriting experience.”

Instant life insurance quotes for women of all health and lifestyle profiles are available at www.lifequotes.com. Customers can now quote anonymously and buy online in total privacy or obtain personalized service and advice from our licensed phone agents.