WESTMONT, Illinois (March 12, 2024) – LifeQuotes.com, the online life insurance price comparison service that offers instant quotes from 50 highly-rated life insurers, today released the results of a new life insurance market survey that confirms consumers with Multiple Sclerosis (MS) have a wide range of cost-effective life insurance plans available to them.

“In honor of MS Awareness Week, we have some very exciting news to share with MS patients who are shopping for life insurance,” said LifeQuotes.com Executive Vice President, Brian Bland. “There is a robust, competitive market out there of life insurers competing to win your business. We know because we track the rates and underwriting guidelines of 50 leading life insurers and our salaried agents are trained in how to advise the best policy fit for MS patients.”

Multiple Sclerosis is the most common disabling neurological disease seen in young adults. According to the National Multiple Sclerosis Society, MS is an “unpredictable, often disabling disease of the central nervous system that disrupts the flow of information between the brain and body.” With MS, the immune system mistakenly attacks myelin, a fatty substance that protects nerve fibers called axons. The axons’ protective coverings become covered in lesions and nerve fibers are exposed, resulting in pain, tingling, and sensation loss (National Institute of Neurological Disorders, 2023).

According to the Atlas of MS, more than 900,000 Americans are living with a diagnosis of MS, which occurs in most ethnic groups. Recent studies show that Hispanic/Latinx and Black people living with MS may face a more aggressive form of the disease.

Bland continued, “Every MS patient has a diagnosis journey and then a journey of varying symptoms that can create anxiety. Knowing that life insurance may be available at affordable rates, can greatly reduce the burden of financial planning and family security.”

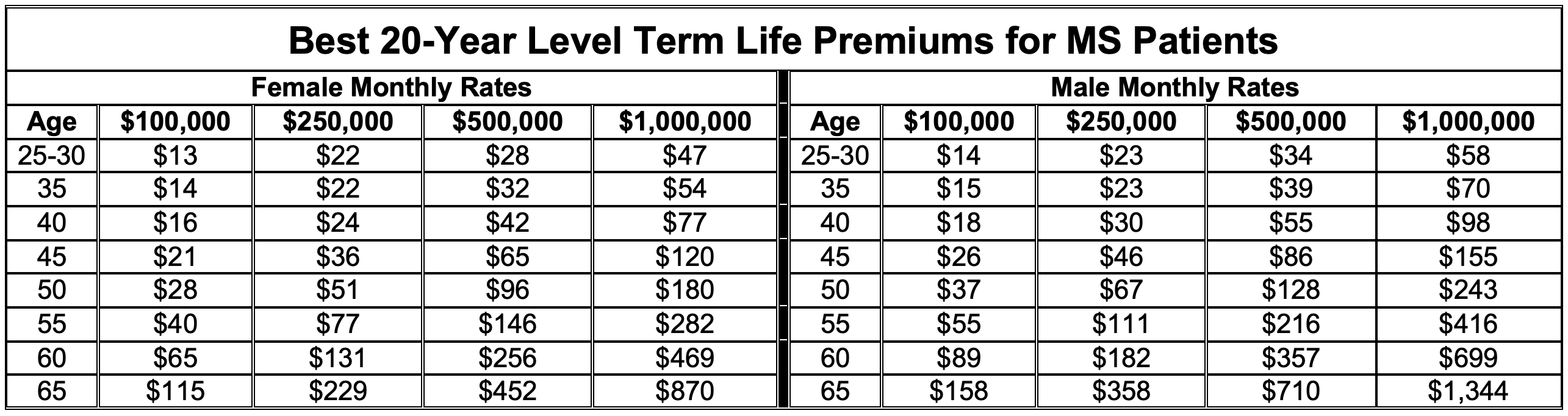

The charts below reveal the best possible monthly rates for consumers with MS for the best-selling 20-year level term life policy, which covers death by any cause, at any time, in any place, except for suicide within the first two policy years (one year in some states). Beneficiaries received benefits tax-free. Other rate guarantees such as 10, 15, 25, 30-year and level-for-life are available at www.lifequotes.com.

Some sample rates shown offer a possible instant decision with no medical exam required. These plans are renewable, without evidence of insurability, to age 90+. Some are convertible to permanent insurance without having to undergo further underwriting.

Continued Bland, “Our 50-insurer database is continually updated, making it a valuable resource for recovering MS patients who are searching for the best buys in life insurance.”

Michelle Zieba, Vice President of Sales, described the life insurance application process, “After receiving initial quotes, our MS customers will then be advised by our life insurance experts as to which plan is best. We handle all of the application preparation and retrieval of medical records so that the selected life insurer can make an underwriting decision, usually within 30 days’ time. For applicants who have been in remission for several years, it’s often possible to skip the exam and receive an instant decision offer of insurance in one phone call.”

MS affects people differently. Most patients will experience short periods of symptoms followed by long stretches of remission, while others have a progressively worsening condition that results in disability. A small number of people with Multiple Sclerosis experience very mild symptoms and little to no disability. Speak to one of our licensed financial professionals to discuss rates offered for different severities of MS at (800) 556-9393.

Multiple Sclerosis Leads to Shortened Life Expectancy

According to the Journal of Neurology, Neurosurgery and Psychiatry, research indicates that there is, on average, a 7-year shorter life expectancy with MS. The mortality rate observed with MS over a 60-year research period was nearly three times that of the general population.

The Journal of Clinical Neurology reports that approximately 1 in every 300 people in the United States are living with Multiple Sclerosis. In 2019, there were 59,345 reported incidences of MS and 22,439 Multiple Sclerosis-related deaths worldwide.

Research suggests that risk of MS incidence peaks between the ages of 30-39, while severity of disability peaks between 50-59 years of age (Front Public Health, 2023). While age, gender, and comorbidity may be influencing factors, The Journal of Clinical Epidemiology found a median survival time of 27 years after diagnosis of Multiple Sclerosis. The wide spectrum of MS severities and their varying effects on mortality highlight the importance of shopping around and choosing to work with a knowledgeable agency that represents many insurers. Shop instant rates from 50 carriers at www.lifequotes.com.

Recent Success Stories

A diagnosis of Multiple Sclerosis does not mean affordable life insurance is unattainable. Below are some recent examples of satisfied customers who have a history of MS:

- Ryan H. of Phoenix, AZ, MS patient diagnosed in 1999 with the most recent episode in 2015, age 44, was able to buy a $250,000 policy for $726 per year.

- Jessica C. of North Pole, AK, MS patient with current minimal residual impairment affecting balance, age 45 with a history of hypertension, was able to buy a $100,000 policy for $606 per year.

- William B. of Bayville, NJ, MS patient with current moderate residual impairment, age 66, history of hypertension, was able to buy a $15,000 Whole Life policy for $1,268 per year.

- Tyler L. of Spring, TX, MS patient with no attacks in the last 10 years, age 45, was able to buy a $1 million policy for $3,035 per year.

Zieba offered this advice to those with MS who are shopping for life insurance, “MS patients can do a lot to prepare to buy life insurance. Know your date of initial diagnosis, any treatments received, and have a list of your prescriptions and doctors ready. Our illustrations list each plan’s acceptance guidelines, so expect to spend a few minutes with our salaried agents on which plan best fits your health profile and budget. These steps will ensure you get the lowest-possible pricing.”

Instant life insurance quotes for those with Multiple Sclerosis of all severities are available at www.lifequotes.com. Customers can now quote anonymously and buy online in total privacy or obtain personalized service and advice from our licensed phone agents.