WESTMONT, Illinois (October 9, 2023) – LifeQuotes.com, the life insurance price comparison service that offers instant quotes from 50 highly-rated life insurers and allows customers nationwide to buy from any company shown, today released the results of a new life insurance survey that confirms the availability of life insurance at competitive prices for recovering breast cancer patients.

“We have good news to report to America’s 4 million breast cancer survivors,” said Michelle Zieba, Vice President. “October is Breast Cancer Awareness Month, so we conducted a fresh life insurance pricing survey of 50 leading insurers, each rated “A” or better, in order to bring the good news to survivors of this disease that there is a robust and competitive life insurance marketplace out there. Our findings reveal that 20-year level life insurance prices for this profile customer are about the same or slightly higher for $100,000 of coverage but lower for coverage amounts of $250,000 and above, which is great news.”

According to the Breast Cancer research Foundation, there are more than 4 million breast cancer survivors in the United States, including women still being treated and those who have completed treatment. In 2023, an estimated 300,590 people will be diagnosed with breast cancer in the U.S.

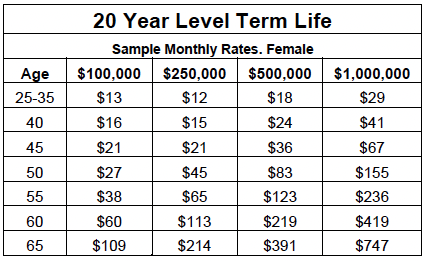

The chart of sample monthly premiums reveals the best possible monthly prices for a 20-year, fully underwritten, level term life policy that covers death by any cause, at any time, in any place, except for suicide within the first two policy years (one year in some states). The sample 20-year term life policy is also renewable, without medical questions, to age 90+ and is also convertible to permanent insurance without having to undergo any further underwriting.

Zieba continued, “High quality life insurance coverage is often available to breast cancer survivors at very attractive rates. We’re featuring rates on the 20-year level term policy because it is the No. 1 selling plan at LifeQuotes.com. Rates on a ten-year policy cost the least, while rates for policies with 25, 30 or lifetime rate guarantees would cost more.”

Life insurers vary widely on how they underwrite and assess recovering breast cancer survivors, which underscores the importance of shopping around and in dealing with an agency that is experienced in placing such coverage. Life insurance above $50,000 is generally available after the period of treatment has ended:

- Cancer-free waiting periods range from none for low grade carcinomas to ten years for localized inflammatory breast cancer, with the most common waiting period being one year.

- Depending on the stage and type of breast cancer, some insurers will even award their absolute lowest “super preferred” rates.

- Applicants should expect to have their medical treatment history and most recent pathology reports looked at closely as a part of the underwriting process.

Zieba added, “Instant life insurance quotes are available at www.lifequotes.com. Our website allows customers to quote in total privacy as we do not ask for name, phone, email or address. Customers who want telephone advice and guidance by phone can talk to our licensed specialists and enjoy our low key style by calling (800) 556-9393.”

Breast Cancer Awareness Month (BCAM), also referred to as National Breast Cancer Awareness Month (NBCAM), is an annual international health campaign organized by major breast cancer charities every October to increase awareness of the disease and to raise funds into its cause, prevention, diagnosis, treatment and cure. The campaign also offers information and support to those affected by breast cancer.

Breast Cancer Awareness Month is a yearly campaign that intends to educate women about the importance of early screening, checkups, and more. This campaign starts on October 1st and ends on October 31st every year.